One Step Up #28

This week, we look at investing in businesses that seemingly don't fade, Stripe, what makes a high performing team, Embedded Education, Duolingo: a case study in product-led growth + more

Fight the Fade - Round 2

Most companies tend to obsolescence i.e. they fade. Products and services start getting duplicated or offered by competition, driving returns down and halting growth.

However, when the ‘mental model’ of mean reversion is applied to those rare FADE-defying companies, the estimate of value can not only be incorrect, but in the wrong ballpark.

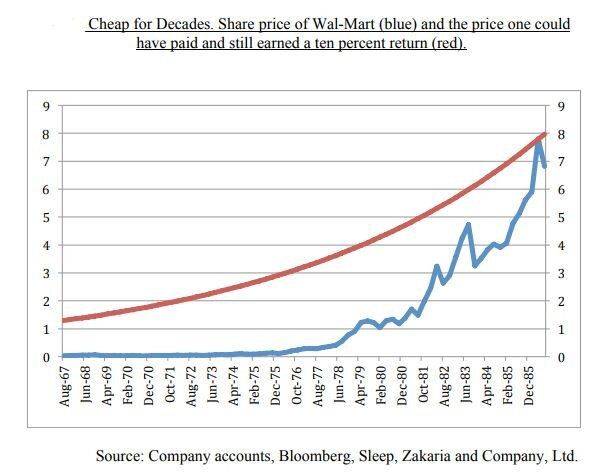

Just how wrong you might wonder? Look at this.

Or this.

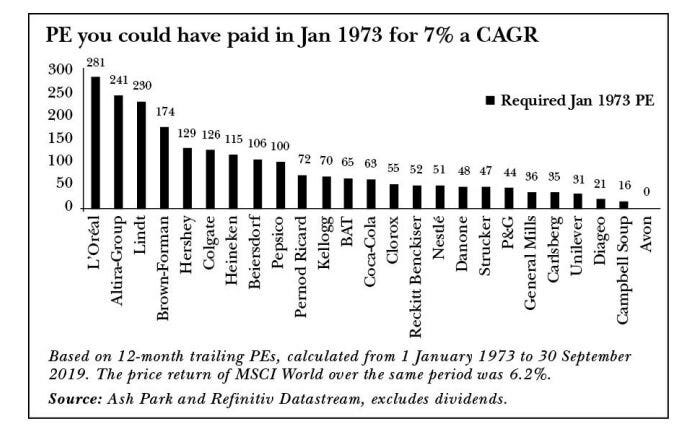

Terry Smith makes the following point in his new book, ‘Investing For Growth,’ “.. the level of valuation which may represent good value at which to buy shares in a high-quality company may surprise you. The following chart shows the “justified” PEs (price-to-earnings ratios) of a group of stocks of the sort we invest in. What does that mean? It looks at the period 1973 to 2019 when the MSCI World Index produced an annual return of 6.2% and works out what PE an investor could have paid at the outset for those stocks and still returned 7% p.a. over the period, so beating the index. You could have paid 281 times earnings for L’Oréal in 1973 and beaten the index return. Or a PE of 126 for Colgate. A PE of 63 for Coca-Cola. Clearly this approach would not fit the mutation of value investing in which the rating must simply be low. Yet it is hard to argue with the fact that these stocks would have been good value even on some eye-watering valuation metrics.”

Quality trumps all.

The article highlights 4 key features to look for and how they act as almost a hedge against your capital loss.

Scale economics shared: coined by Nicholas Sleep, it describes a business which shares the benefits of scale with it’s customers; ‘increased revenues begets scale savings begets lower costs begets lower prices begets increased revenues’.

Increasing Returns (loved the bit on Charlie Songhurst’s thinking around valuation)

Addressable market/opportunity

Management & culture

When it come’s to long term business success, sharing scale benefits with the customer, grasping increased returns, optimizing your market and ensuring an enduring culture can go a long way to fight the FADE that inflicts typical businesses. The companies that benefit from a few of these are likely to be long-term success stories.

Jack Clark, who won 28 rugby championships in 36 years, on what makes a high performing team

My favorite bits (although you’re better off watching the 12 minute video):

Mindset: Grateful for everything. Entitled to nothing.

Seniority is your IP. If you can’t monetize it by creating performance in the moment, it doesn’t mean anything - it’s worthless.

Mental toughness: The ability to focus on the next most important thing.

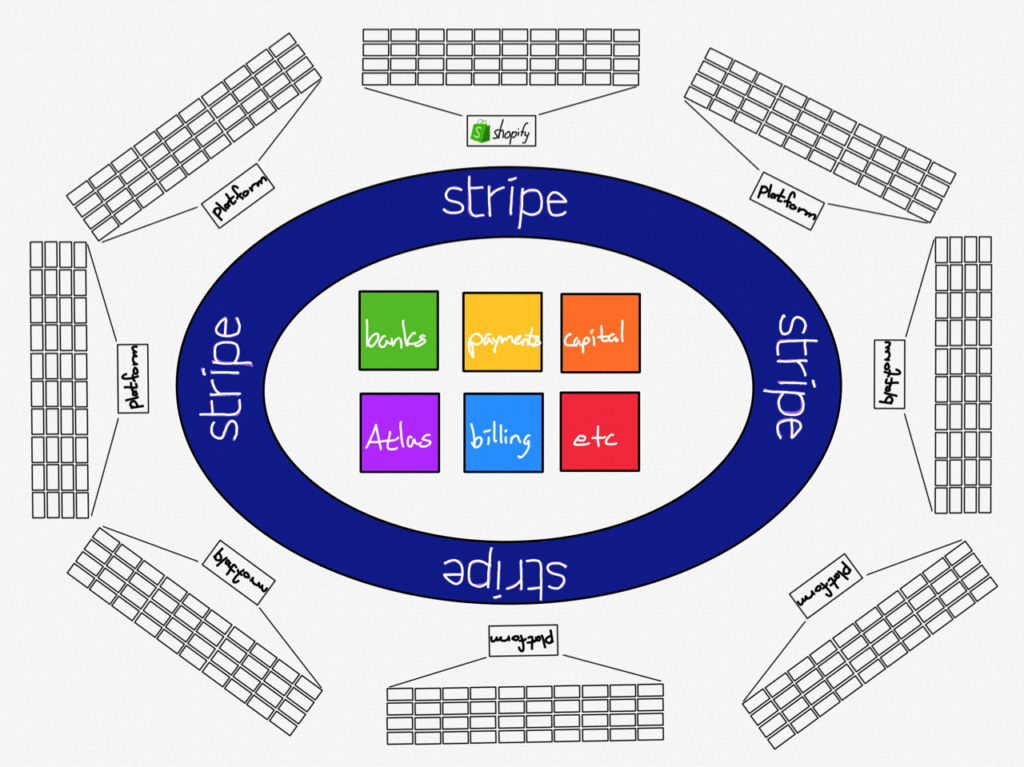

Stripe: all you need to know about the next company which is leading its competitors down the path of questioning themselves - “What if Stripe enters this space?”

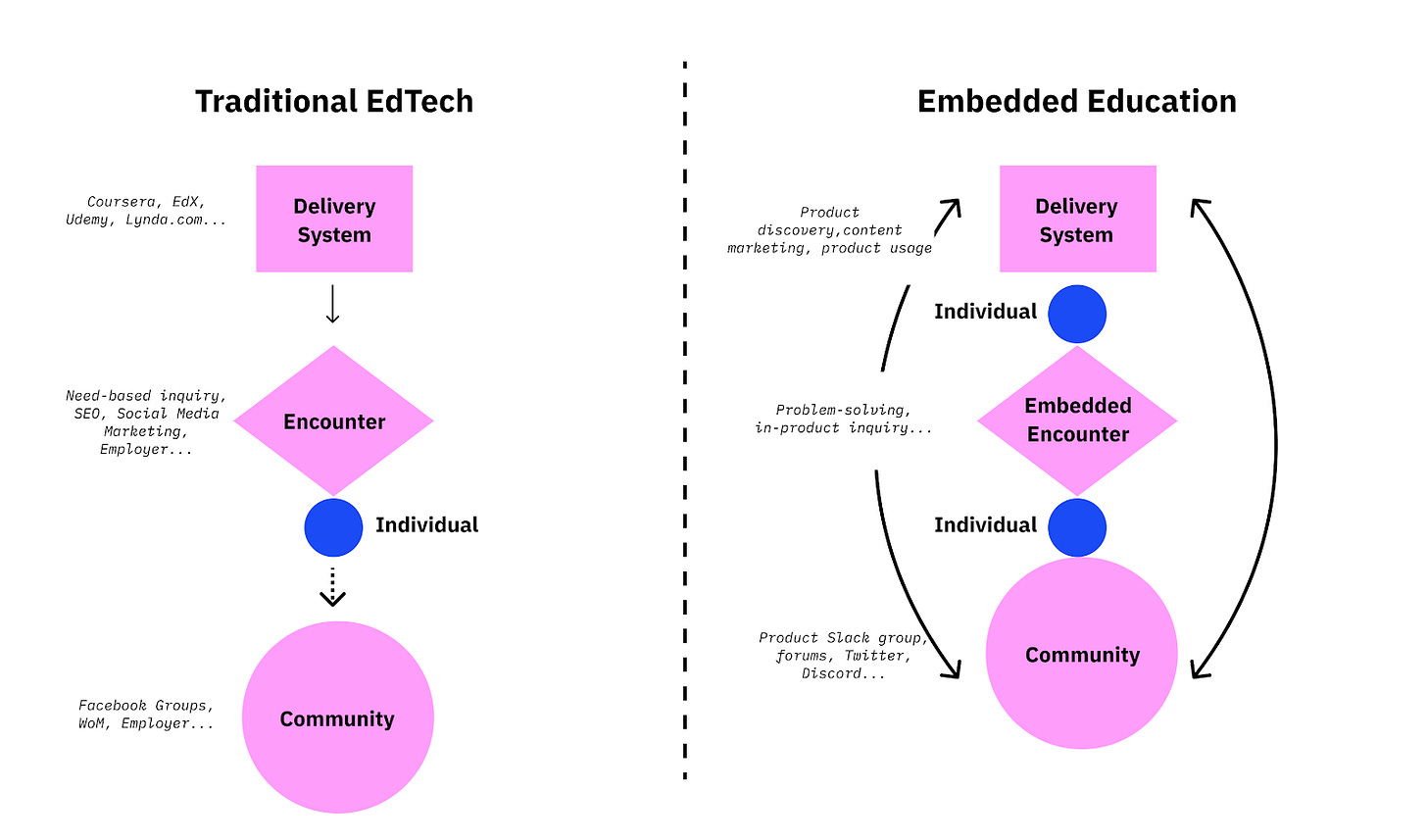

Learning no longer lives on an individual platform. Rather, learning happens everywhere. We’re entering a new age of “Embedded Education”. What makes phrases like “software is eating the world” or “every company is a fintech company” so powerful is that once we hear it, we can’t unsee it. Every company all of a sudden can become a software company, and every software can provide finance as a service. Once we start paying attention to Embedded Education, platforms are now filled with the potential to become some of the most effective education delivery channels.

Embedded education is the practice of educating people through encounters that they already have with systems that exist primarily for non-educational purposes.

Some example:

Interview with Legendary Investor Pat Dorsey, CFA

Wide ranging article covering investment mistakes, a short discussion on Facebook, moats and a lot more. Pat’s book - The Little Book That Builds Wealth - was very influential in helping me understand quality, sustainable businesses.

But the real money, if you’re thinking about the really compounding capital overtime, is not the business that has built the moat, it’s the business that is building the moat. That’s probably a business that’s younger. It’s got a runway ahead of it and where each dollar of incremental cash flow is being invested at a progressively higher incremental return on capital as the business that is gaining scale and the moat is growing stronger.

How Duolingo grew from 5 mn to 200 mn users in 5 years using product-led growth:

Duolingo’s product-led growth was based on 3 main tenets:

Gamification

Obsessive A/B testing

Learning-driven

I hope you enjoyed reading #28 today. Please share it with people you think would enjoy this!

Till next time.