One Step Up #30

This week, we look at lessons from Nicholas Sleep, how Copart is making a billion dollars from a junkyard, lessons from the tech bubble, rising markets on the back of a grim environment + more

Two tips for the new year:

Be grateful

Be optimistic

That’s it. Let’s go. 🚀

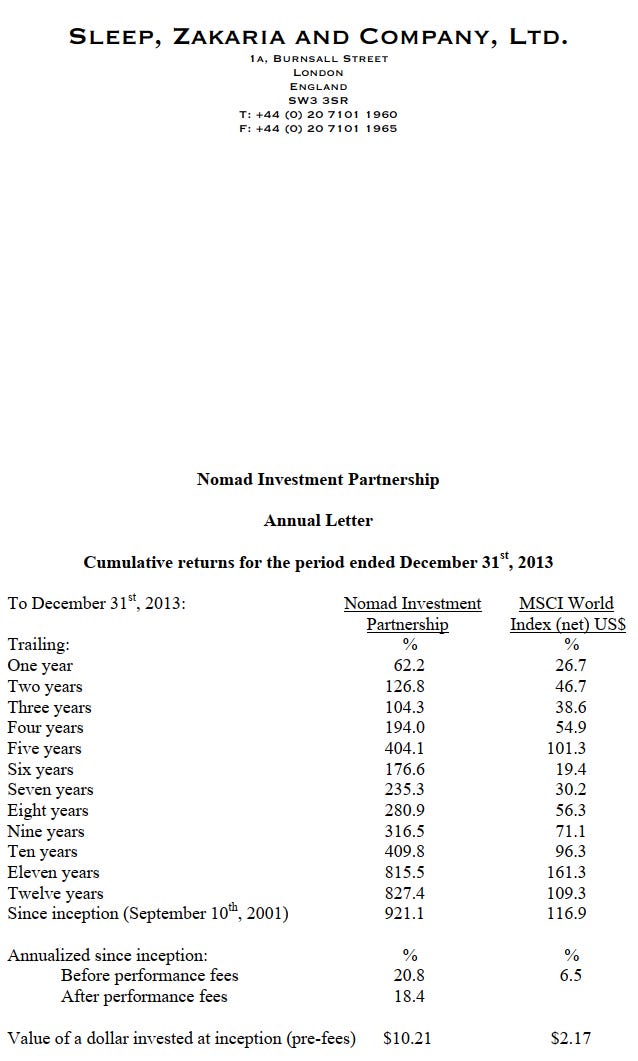

Learning from Nicholas Sleep

On multidisciplinary learning and studying geography:

Geography is a subject with an identity crisis – it is the confluence of geology, physics, chemistry, oceanography, climatology, biology and that is just physical geography. Human geography deals with sociology, psychology, statistics, economics – so it is the ultimate polymath course. Geography just reached in to other subjects and grabbed what it thought it had to have. Indeed, the reason I studied Geography at all was because of this polymathic quality.

We can do better with the compounding businesses these days - and they are much less stressful.

The trick, it seems to us, if one is to be a successful long-term investor, is to recognise the sources of enduring business success, get in early and own enough to make a difference.

Nomad’s Partnership Letters 2001-13: Click here

How Copart is making a Billion Dollars from a Junkyard

Adair likes to call Copart “recession-proof” and “pandemic-proof.” After the financial crash in 2008, the price of used vehicles fell as would-be car buyers cut back on spending. But that same price drop also made it cheaper for insurers to write off lightly damaged cars and dump them entirely, sending more salvage cars to Copart’s lots and generating more fees from hauling them away.

At the start of the pandemic this past spring, the opposite happened, but again with positive effect: Fewer people were driving, leading to a decline in accidents, which meant insurers were totaling fewer cars. The decrease in the supply of wrecks meant that Copart was paying more for each one. But higher prices also ensured that Copart made more money on the portion of its business that sells fixable cars. Nice business. Higher prices? They profit. Lower prices? They profit.

Eye opening on many levels for me. Just goes on to show hum the markets can humble everyone alike.

Lessons from George Vanderheiden, one of the greatest investors I’ve ever known.

Fascinating look at an investor who I’d never heard of until a few hours earlier.

My two favorite bits:

Being too early is the same as being wrong. Analysts and fund managers often say that “they were early,” rather than wrong. George’s point was that being too early is a mistake rather than a defense. Time in the market is more important than timing the market, but timing does matter for individual stocks as the “price you pay determines the return you get.”

Client alpha” really matters. “Client alpha” is the idea that having the right clients who are aligned with what you are trying to achieve as a fund manager is critically important. Otherwise capital is often taken away at exactly the wrong time. Buffett was able to stay in the game in 1999 because he had a permanent capital vehicle and a carefully cultivated public image. This is one reason that being a good communicator is important to being an investor if one is managing external capital — one cannot have “client alpha” if the clients don’t understand what the fund manager is trying to accomplish. George was a great communicator, but no one has ever been better than Buffett.

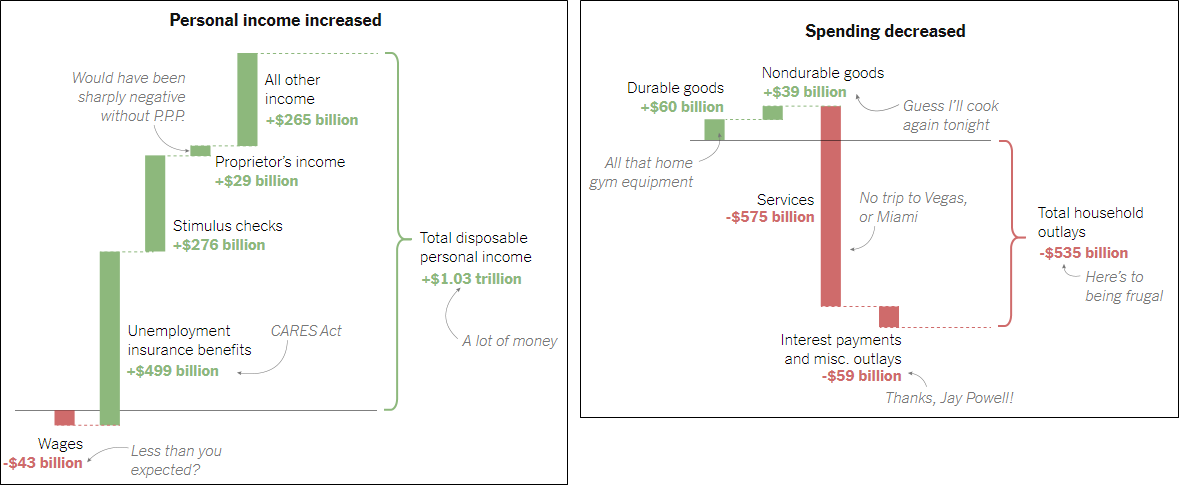

Why Markets Boomed in a Year of Human Misery

3000 deaths a day

800,000 people filing for unemployment every week

And the market just keep on rising. How?

The millions of people no longer working because of the pandemic were disproportionately in lower-paying service jobs. Higher-paying professional jobs were more likely to be unaffected.

Wild.

Willpower is the war against our own nature. It is the denial of self and stiff like rigor mortis. It is Sisyphus rolling a boulder up the mountain for eternity.

We can stay rigid and fight for a little while, a month or two, maybe longer if we’re a real good faker, but we can only feign who we are for so long.

To me, the opposite of willpower is flexibility, suppleness, softness - the stuff Lao Tzu was writing about in the Tao Te Ching.

A metaphor I love is Judo.

Judo translates to “gentle or yielding way.”

One of the central tenets is allowing the force of your opponent to do the work for you and using his loss of balance to win.

Softness controls hardness, the judoka says.

Instead of forcing ourselves to change, we can yield to reinvention.

Till next time.

Always remember: