One Step Up #31

This week we look at the future of marketplaces, FinTech (Plaid, Dee Hock/Visa), Optionality in Investing, India Stack+ few thoughts on writing and happiness

Tweet of the year so far:

The future of marketplaces: coordination, capital, and creativity

How much the end user experience can be improved. Amazon and Shopify tackled logistics for their sellers before other parts of the value chain because customers care a lot about the speed of delivery, and there was a lot of slack in the last mile to improve this.

Whether or not there is already an underutilized fixed asset on the supply side. As Kevin Kwok noted, many of the most successful marketplaces tap into an existing asset that is underutilized today, such as spare bedrooms for Airbnb and junk in attics for Ebay. Before taking on the heavy burden of building it themselves, most marketplace founders will seek out and exploit these kinds of opportunities.

Degree of gains from scale. When scale benefits are high, marketplaces may not take them on directly at all, but instead integrate with third parties. Future marketplaces may not have to directly underwrite risk like Faire does, but instead get “risk as a service” from Stripe Capital. Similarly, Doordash went through the pain of building its own logistics networks, but now others can tap into their white-labeled solution.

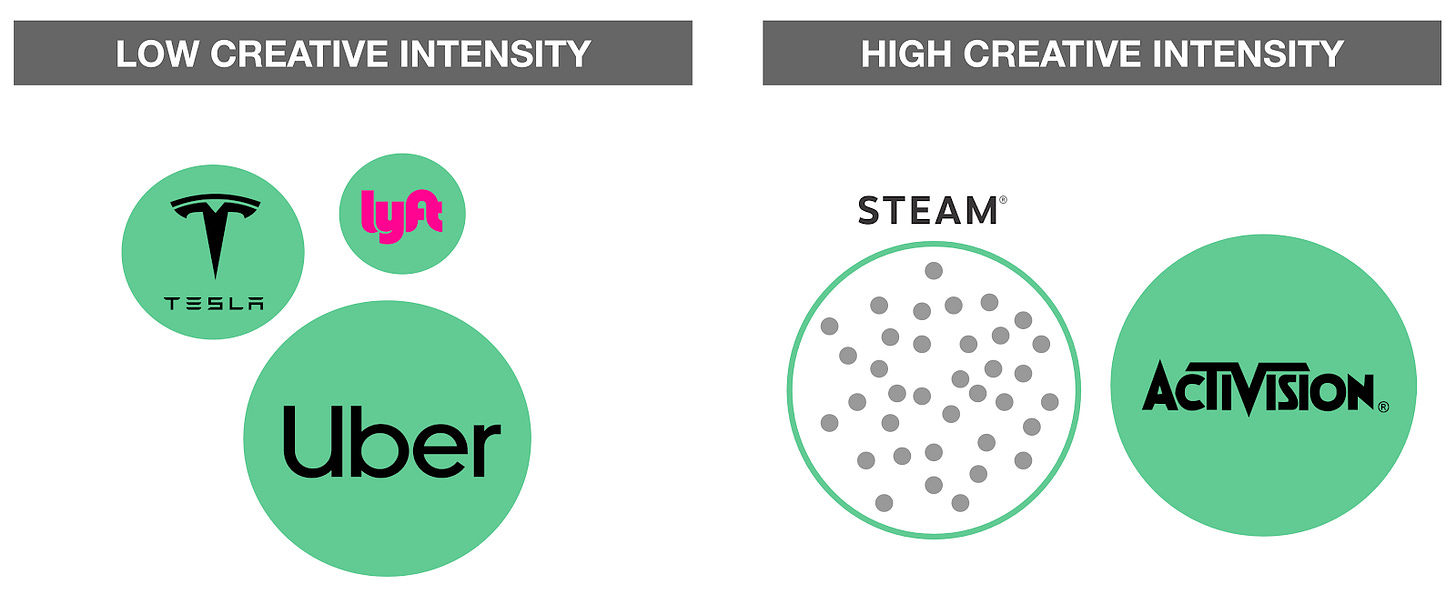

We can plot marketplaces on a spectrum based on the creativity intensity of the industry they compete in. Those on the left are likely to evolve or be replaced by super-suppliers in the long term. The business models on the right are likely to persist much longer.

The future is bifurcated

As becomes clear in the examples above, in creatively intense industries, marketplaces will own some of the market in the long term, but they will not be the only game in town.

That’s because there are still customers that are optimizing for some mix of quality, speed, and cost, while others want selection and innovation. In video games this is the difference between people who want to play Call of Duty 47, and those who want to continually seek out new and interesting indie games. In pizza it is the difference between people who want the reliability and cost of Dominoes, and those who want to seek out the best local slice.

Ultimately, the level of creative intensity will determine whether an industry fully consolidates into super-suppliers, or whether it bifurcates into super-suppliers for the mainstream and marketplaces for the long tail.

Earlier this week, Visa called off it’s planned $5bn acquiaition of Plaid.

Plaid acts as an intermediary between apps (like Venmo) and your bank so that you can log in and share data securely.

Developers use Plaid to connect their applications to financial institutions, and work with those accounts (view balances, transaction history, etc.). If you’re a developer working at Venmo, you’d hook up your app to Plaid so that your users can connect their Bank of America accounts and get money into Venmo.

End users: Plaid isn’t just a set of APIs - they also provide a user interface for connecting with banks. If you’re a Venmo user and you want to connect your account to Bank of America, you’ll probably get a screen that looks something like this:

This page was not developed by Venmo - it’s from Plaid. For most of their customers, they take care of the entire integration process, not just the backend. This is important, because it lets them own the data flow and provide value by encrypting and keeping your credentials secure.

Dee Hock, the Father of Fintech

One of his ideas is a framework for thinking about problems. “Understanding events and influencing the future requires mastering of four ways of looking at things; as they were, as they are, as they might become, and as they ought to be.”

A Framework for Understanding Optionality - ShawSpring Partners

Fatastic letter backed with case studies in companies like Amazon, SEA, Match Group, JD, Square and more. MUST read for any student of the investment process.

The four types of optionality:

New business(es): e.g. Amazon’s entry into cloud computing

Product/category expansion: e.g. Square’s entry into the Retail and Restaurants segment

Strategic Shift / Evolution: e.g. Adobe’s transition from on-premise to software-as-a-service (“SaaS”)

Geographic expansion: Starbucks going Global

Take a copy of this and put it up above your desk. Favorite bits:

No one wants a lecture. Everyone wants a story, which is anything that subtly puts data into relatable terms. It makes everything easier to remember and contextualize.

If you have an idea but think “someone has already written that” just remember there are 1,010 published biographies of Winston Churchill.

Delete without mercy. Jason Zweig says, “you can never create something worth reading unless you are committed to the total destruction of everything that isn’t.”

Whoever says the most stuff in the fewest words wins.

A Lesson on Happiness from "The Fisherman and the Banker"

The Fisherman And The Banker

by AnonymousA vacationing American businessman standing on the pier of a quaint coastal fishing village in southern Mexico watched as a small boat with just one young Mexican fisherman pulled into the dock. Inside the small boat were several large yellowfin tuna. Enjoying the warmth of the early afternoon sun, the American complimented the Mexican on the quality of his fish.

“How long did it take you to catch them?” the American casually asked.

“Oh, a few hours,” the Mexican fisherman replied.

“Why don’t you stay out longer and catch more fish?” the American businessman then asked.

The Mexican warmly replied, “With this I have more than enough to meet my family’s needs.”

The businessman then became serious, “But what do you do with the rest of your time?”

Responding with a smile, the Mexican fisherman answered, “I sleep late, play with my children, watch ball games, and take siesta with my wife. Sometimes in the evenings I take a stroll into the village to see my friends, play the guitar, sing a few songs…”

The American businessman impatiently interrupted, “Look, I have an MBA from Harvard, and I can help you to be more profitable. You can start by fishing several hours longer every day. You can then sell the extra fish you catch. With the extra money, you can buy a bigger boat. With the additional income that larger boat will bring, before long you can buy a second boat, then a third one, and so on, until you have an entire fleet of fishing boats.”

Proud of his own sharp thinking, he excitedly elaborated a grand scheme which could bring even bigger profits, “Then, instead of selling your catch to a middleman you’ll be able to sell your fish directly to the processor, or even open your own cannery. Eventually, you could control the product, processing and distribution. You could leave this tiny coastal village and move to Mexico City, or possibly even Los Angeles or New York City, where you could even further expand your enterprise.”

Having never thought of such things, the Mexican fisherman asked, “But how long will all this take?”

After a rapid mental calculation, the Harvard MBA pronounced, “Probably about 15–20 years, maybe less if you work really hard.”

“And then what, señor?” asked the fisherman.

“Why, that’s the best part!” answered the businessman with a laugh. “When the time is right, you would sell your company stock to the public and become very rich. You would make millions.”

“Millions? Really? What would I do with it all?” asked the young fisherman in disbelief.

The businessman boasted, “Then you could happily retire with all the money you’ve made. You could move to a quaint coastal fishing village where you could sleep late, play with your grandchildren, watch ball games, and take siesta with your wife. You could stroll to the village in the evenings where you could play the guitar and sing with your friends all you want.”

Do not waste your most precious resource — time. Capitalize on being a “time billionaire” by staying present every second. Having a billion seconds is priceless.

The three layers of India Stack. Source: iSPIRT

"There is no technical stack in the world with a country's name as a prefix. What the Indian government and regulators have done together with the common national identity through a digital system and a common national API for payments, is nothing but brilliant. India is one of the first countries that has a platform first approach, with the platform being secure, robust and reliable. It is a role model for many other countries to follow" - Sri Shivananda (Paypal SVP and CTO)

Till next time.