One Step Up #32

This week, we look at physical retail's apparent death, value vs. growth à la Howard Marks, Sun Tzu’s five factors business framework, influencer marketing, Signal + Privacy & India's fake job problem

Bit Structures

If I had a penny for every time someone over the past year mentioned to me the apparent death of physical retail due to the supposed acceleration in e-commerce adoption…

Amazon (retail, ex-cloud) and Shopify both grew more in absolute dollar terms than Walmart did during the second & third quarters of the year (Amazon revenue +$47bn, Shopify GMV +$32.4bn, Walmart revenue +$14.2bn). Major retailers like Lululemon and Nike saw an increasing amount of their revenue derived from online sales (Lululemon averaged roughly 50-60% of revenue from eCommerce vs 29% last year; Nike averaged 30%). People tried grocery delivery for the first time. Online crushed physical, once and for all.

But zooming out paints a different, less teleological, not quite so meteoric picture. Per the US Census Bureau, in Q3 of 2020, online sales were...just 14.3% of total retail sales -- admittedly up 30% from last year, but down from their height of ~16.1% of sales in Q2.

Put another way...if your memory of the past year was erased, and I told you that a pandemic would rip across the world, rendering us all loyal supplicants to online shopping, what percent of sales would you assume eCommerce would be of overall consumption? Probably pretty high, right? I posed the question to some family and friends, and everyone guessed in the 50-80% range. The reality -- a little over 14% of sales -- is actually shocking. The takeaway shouldn’t be “eCommerce is eating the world” it should be “despite lockdown, store closures, mass layoffs, and global logistics networks that rival militaries in terms of sophistication, eCommerce was less than 1/6th of sales in the US.”

Howard Marks’ latest memo, details the dichotomy of Value and Growth:

Tao of Value: Investor Letter – 2020 Q4

The Sun Tzu’s five factors business framework remains very effective for me to pick the best breed of business. I would like to briefly relist them:

Tao: The “spiritual” consideration of a business, including mission, value, culture, and benefit to all stakeholders.

Meteorology: Addressable market, competitive landscape

Topography: Profitability, moats, financial strength

Commander: Management (integrity, capital allocation skills, transparency, fairness to minority shareholders) - System: Governance, incentive system, etc

The letter also talks about the The Great “Retailization” of the US Market.

One hallmark of US equity market in 2020 is what I called the great “Retailization”, where the asset pricing function seemed to heavily shift to the hands of retail investors. Lately, I was able to get hands on a proprietary dataset which confirmed this phenomenon. On left chart below, you can see the retail trades in % of total equity market trades held at a level of 12% from 2017 to early 2020, then jumped up to a level of 25% in late 2020.

Why influencers will become the largest distribution networks this decade

If you’re not familiar with the “LikeToKnowIt” app, here’s some background: A social media user sees an influencer wearing a jacket that they like, they take a screenshot of the post and upload it to the LikeToKnowIt app. The app returns results of where the user can buy that jacket.

This seems like a very friction induced process — log into social media, find a jacket you like, take a screenshot, open different app, upload picture, click results to go to a different site, put in credit card information, checkout. But it works. In 2018, the LikeToKnowIt app add 1.3 million users and generated $300 million in retail sales (Source: Forbes.) Again, people are always looking to buy products with stories and experiences they resonate with through who they are or want to be.

When consumers feel a sense of belonging to a person or community, they are more likely to engage with a product in the name of social proofing, even if they have to work through inefficiencies.

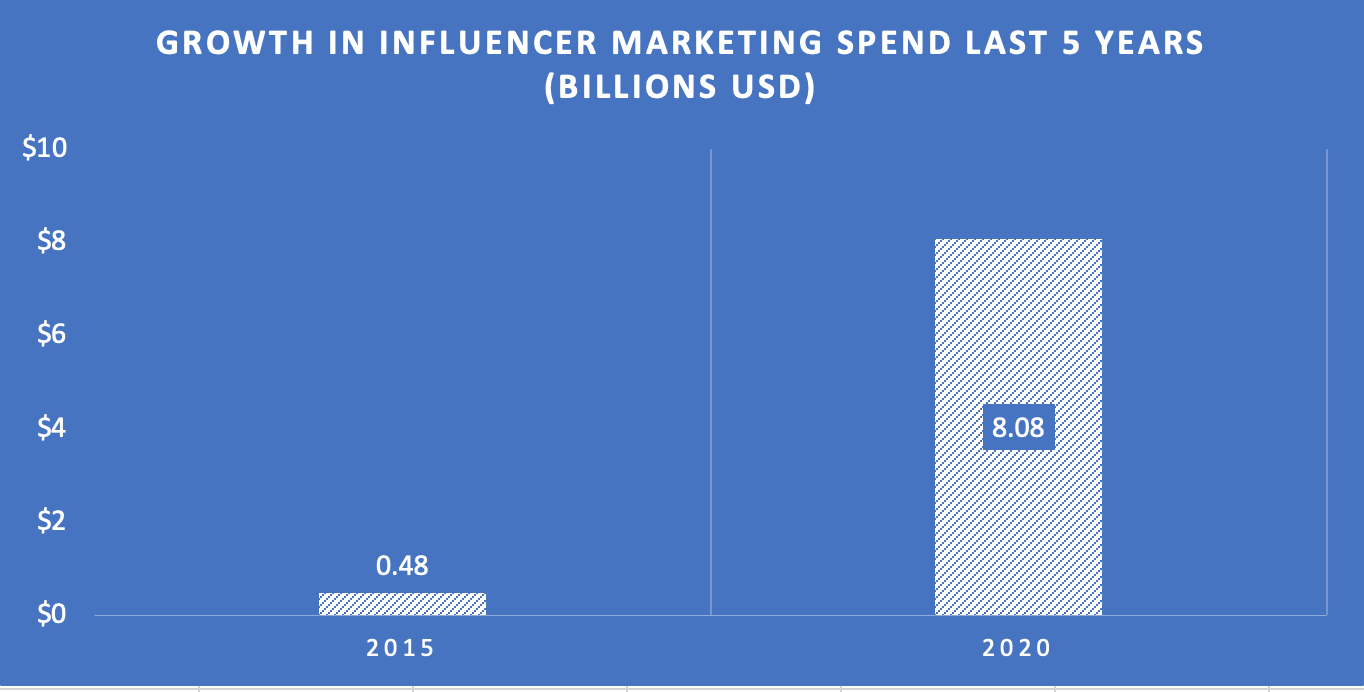

In just 5 years time, influencer marketing spend has disproportionately outpaced global advertising spend (CAGR: 50% vs. 4.8% respectively). The key realization made is that consumer brands can extract more value per each dollar spent in marketing. Brands do not just cater to a single customer to buy a product, they start building loyalty through the influencer’s audience.

Unless you’re living under a rock, it would be hard to miss the mass exodus of people from WhatsApp and onto Signal and/or Telegram due to Facebook’s push with their updated ToS for WhatsApp which gives them access to certain information like your payment info, purchases to make ads on FB more directed at you, the user.

This article highlights the story of Signal - their unusual history and what’s in store.

This article is wild + riveting.

India has never had enough jobs for the growing number of citizens who are eligible ot enter the workforce - and the pandemic did not help in any way.

Between April and August, 21 million salaried workers became unemployed.

There have been widespread reports of unemployed white-collar workers having to shift to worse-paid manual labor just to make ends meet.

The International Monetary Fund has projected a 10.3 percent decline in the economy in the 2020–21 fiscal year. India’s own official estimates forecast a 7.7 percent contraction in gross domestic product, the biggest annual shrinkage since 1952.

According to CMIE, even by the end of December, nearly 15 million fewer people were employed than at the start of the first lockdown. “Those who lost their jobs were concentrated in urban regions, among women, among the relatively younger workers, the graduates and post-graduates and the salaried employees,” Mahesh Vyas, CMIE’s managing director.

Till next time.

Life is about execution rather than purpose.