One Step Up #35

This week, we look at the New York Times, the Ownership Economy, Retraining America ($LINC), Joseph Edelman (Perceptive Advisors), An investing lesson from Hayek & Semper Augustus Letter to Clients.

The Complete History and Strategy of The New York Times

Start with reading Mine Safety Disclosure’s analysis of $NYT here, and follow it up with this (podcast) super interesting deep dive on the NYT’s storied history, spanning over 170 years.

From losing subscribers, declining ad revenue, increasing debt load and poor acquisitions, this is where the NYT is today.

Full disclosure: I’m long $NYT.

The Ownership Economy: Crypto & The Next Frontier of Consumer Software

Ownership is a powerful motivator for users to contribute to products in deeper ways, be it with ideas, computing resources, code, or community building. This more cooperative economic model helps ensure better alignment with users over time, resulting in platforms that can be larger, more resilient, and more innovative. This is the Ownership Economy, and beyond being a positive social endeavor, the platforms building it are able to leverage the strongest form of market incentives to grow network effects.

Retraining America: Mass Unemployment + China + Infrastructure = LINC

Aaron Edelheit’s investment thesis for Lincoln Educational Systems ($LINC).

Joseph Edelman runs Perceptive Advisors, which focuses on small- and midcap companies, investing 75 to 80 percent of the hedge fund’s assets in biotech companies and the rest in specialty pharmaceutical companies, health care IT firms, diagnostics companies, and firms that make medical devices. But the firm’s bread and butter is development-stage companies that make game-changing drugs.

The flagship fund has generated annualized gains since inception of 30 percent net of fees .

A few lessons learned from him:

We gain a competitive edge by understanding the ‘perception’ of these events and then only investing in ‘reality’ after conducting in-depth research.

We are really focused on only looking forward. You have to take your history with the stock out of the way.

An investing lesson from Hayek

This is some of the finest investment writing I have ever read.

Gardener approach entails an exclusive focus on controllable inputs, while entirely ignoring uncontrollable outputs. When we find right management, industry, company, moat & valuation, it’s analogous to lining up seed, soil, nutrients, sunlight & water. Long history suggests that doing so yields a good crop. As we can do no better, we’re done. Conviction rests on knowing that right inputs are in place. Conviction isn’t based on pretending to know individual outcomes. Asking how high a particular sapling will grow is as silly as it’s unanswerable.

Hayek’s distinction also helps foster the right temperament for investing. Sculptors believe in precisely shaping outcomes. They’re in control. They’re creators. Gardeners know their limitations. It’s mostly outside their control. They’re more likely to pray to a Creator than think they’re one. In addition to fostering humility, gardener mindset helps with inaction. If inputs don’t line up, there’s no point trying. Even when they do, there’s no way to rush outcomes. Waiting patiently is part of job description. This also helps distinguish investment from speculation. Since future is unknowable in both, it’s sometimes hard to tell. In investment, inputs are known, outputs are unknowable. In speculation, even inputs are unknowable. I dump on shiny things and dodgy money because no one knows what inputs need to line up for a decent harvest.

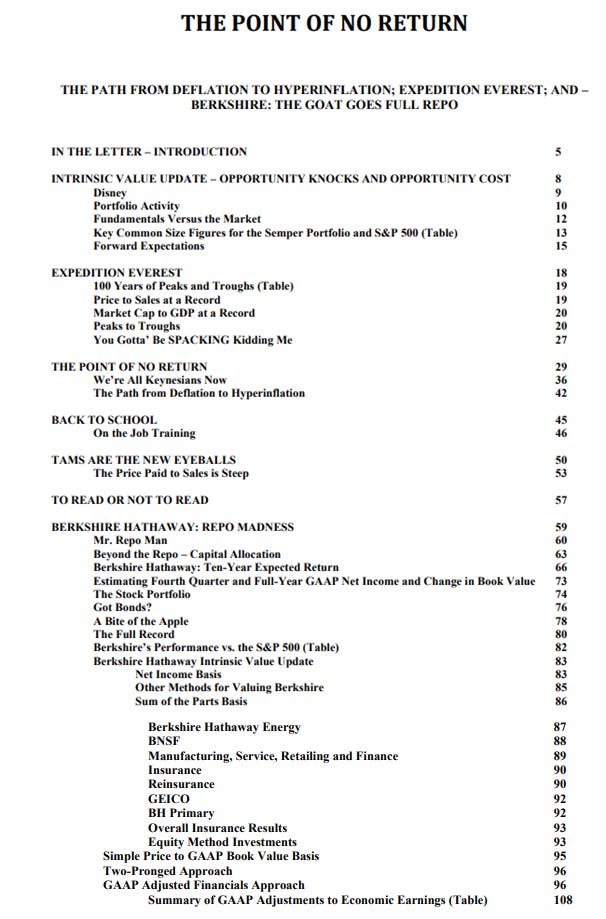

Semper Augustus Letter to Clients: 2020 - The Point of No Return

I’ll just leave the table for contents here for anyone to decide why they absolutely should read this letter. It covers the length and breadth of the investing world and has a little something for everyone.

Till next time.

All sharks are born swimming, sir.