One Step Up #39

This week, we look at the "Stonk Market", Platform Brands, the Bloomberg terminal, dollar cost averaging + more

The Stonk Market

If there was only one article to help you navigate the current market environment - read this.

Key takeaway: The market is no longer driven by fundamentals - it’s driven by memes. No longer a metaphor, but a living structure – the stonk market.

The article discusses the memefication of the markets through SPACs, The Tesla Effect and Elon Musk, ARK Invest, NFTs, GameStop and Retail Investors.

You will not be let down.

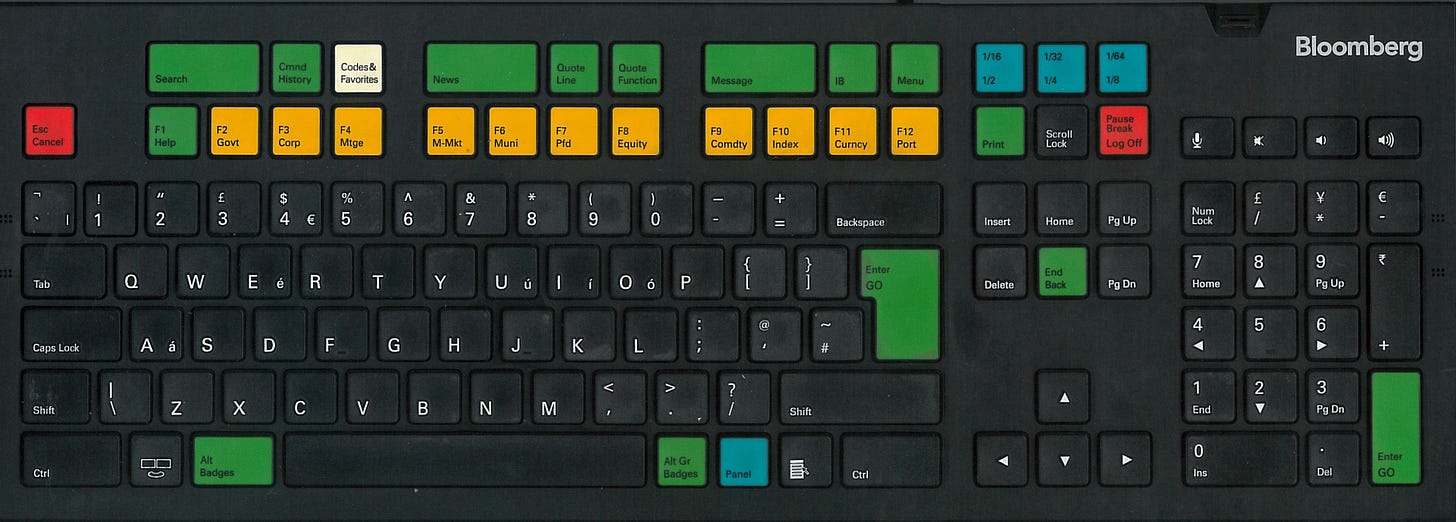

You merely adopted dark mode: The best product too few people have ever used

The Bloomberg Terminal is like the Batsuit: I wouldn’t wear it to a party, but there’s nothing else I’d rather wear if I wanted to wake up feeling like I could save Gotham City.

Instead of leveraging outsiders to build their brands, a crop of forward-thinking companies have started partnering with a new set of stakeholders: their own employees.

Individuals who can engage their company’s customers can serve as powerful demand generation channels. But they must use the right approach. Those who only share company blog posts and press releases will struggle to retain followers. To engage a discerning audience, employees must share high-quality content that rivals the best creators on their chosen platform.

It is through the transitive property of trust that companies and employees can share audience members. Once an employee builds a trusted relationship with an audience, their followers are more inclined to trust the individual’s employer. After all, the choice of where to work is not a decision most people take lightly. When an impressive person shows their dedication to a company, it signals to audience members that the employer must be impressive as well.

As the brand gains prestige through its public-facing employees, it can distribute the status back to its employees in the form of a virtuous cycle. This is the magic of a strong platform brand.

This is the story of the bees in Brooklyn who produced red honey, which led to an investigation at a nearby maraschino cherry factory, which led to the discovery of a marijuana farm beneath the factory.

A good perspective for early stage VC investors on building relationships.

The first time I meet you, you are a single data point. A dot. Because I have no observation points from the past, I have no sense for where you will be in the future. Thus, it is very hard to make a commitment to fund you.

For this reason I tell entrepreneurs the following: Meet your potential investors early. Tell them you’re not raising money yet but that you will be in the next 6 months or so. Tell them you really like them so you want them to have an early view (which is what all investor’s want). When you’re with them lower the bar by telling them, “we haven’t shipped product yet, we have lots of decisions still to make, but we’d like to show you our prototype” or obviously if you’re more advanced show what you have and what your roadmap looks like.

Most importantly tell them what you plan to achieve by the next time you see them. Hopefully by then you’ve made good progress. You’ll be able to give them an update on key hires, pilot customers, key tech innovations — whatever. Keep these interactions low-key and short. Quick coffees, whatever. Swing by their offices to make it easy for them to say yes and promise not to take up more than 30 minutes for the update (and stick to it).

The thing is, by the time I get to know you I start to see patterns (a line). How can you prove tenacity, resiliency or ability to pivot in a single data point?

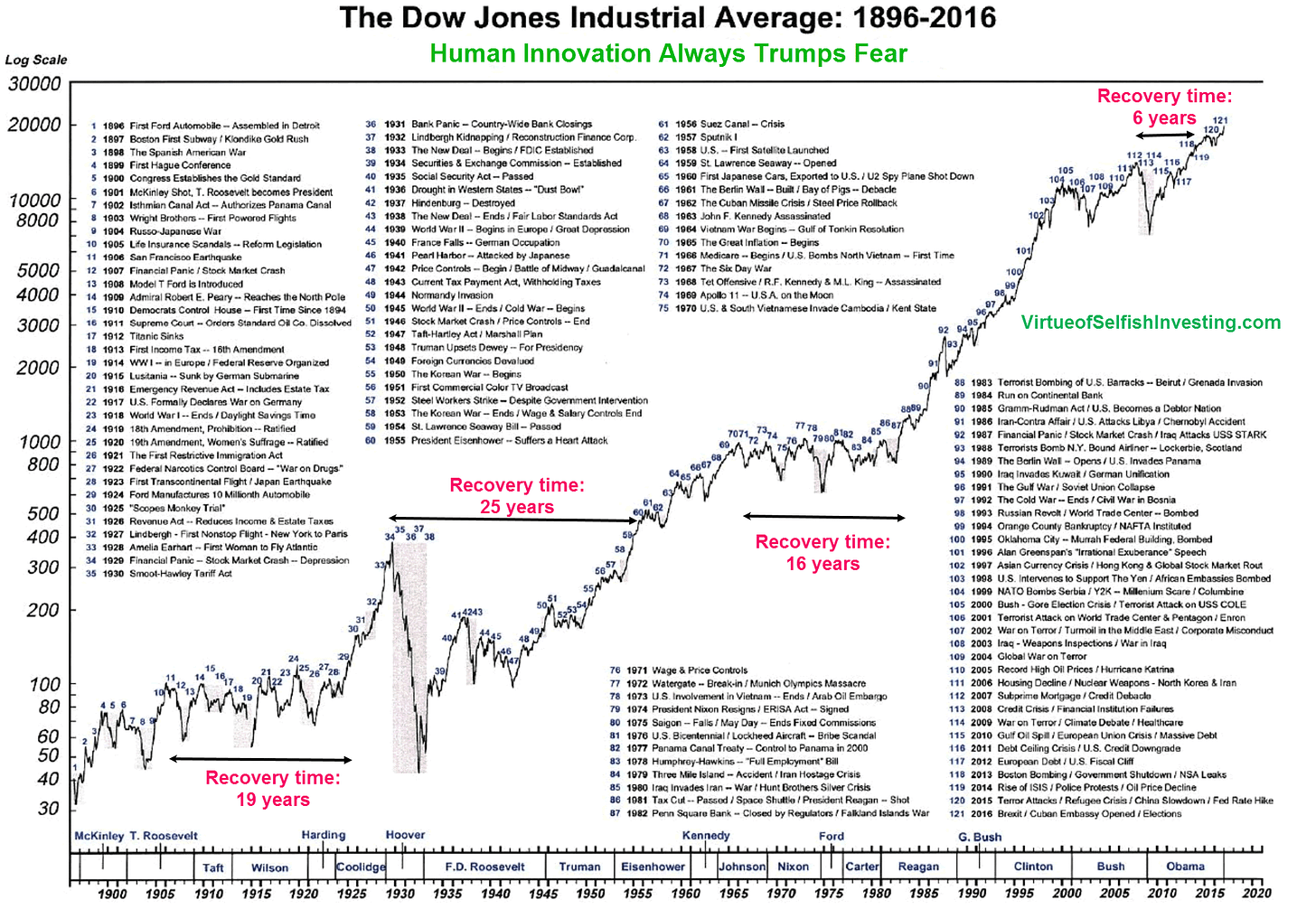

Even God Couldn’t Beat Dollar-Cost Averaging

Every investor should read this - data backed article on why dollar cost averaging makes sense.

Timing the market is incredibly difficult - missing the bottom by just 2 months lowers the chance of outperforming the DCA (dollar cost averaging strategy from 30% to 3%.

If you attempt to build up cash and buy at the next bottom, you will likely be worse off than if you had bought every month. Why? Because while you wait for the next dip, the market is likely to keep rising and leave you behind.

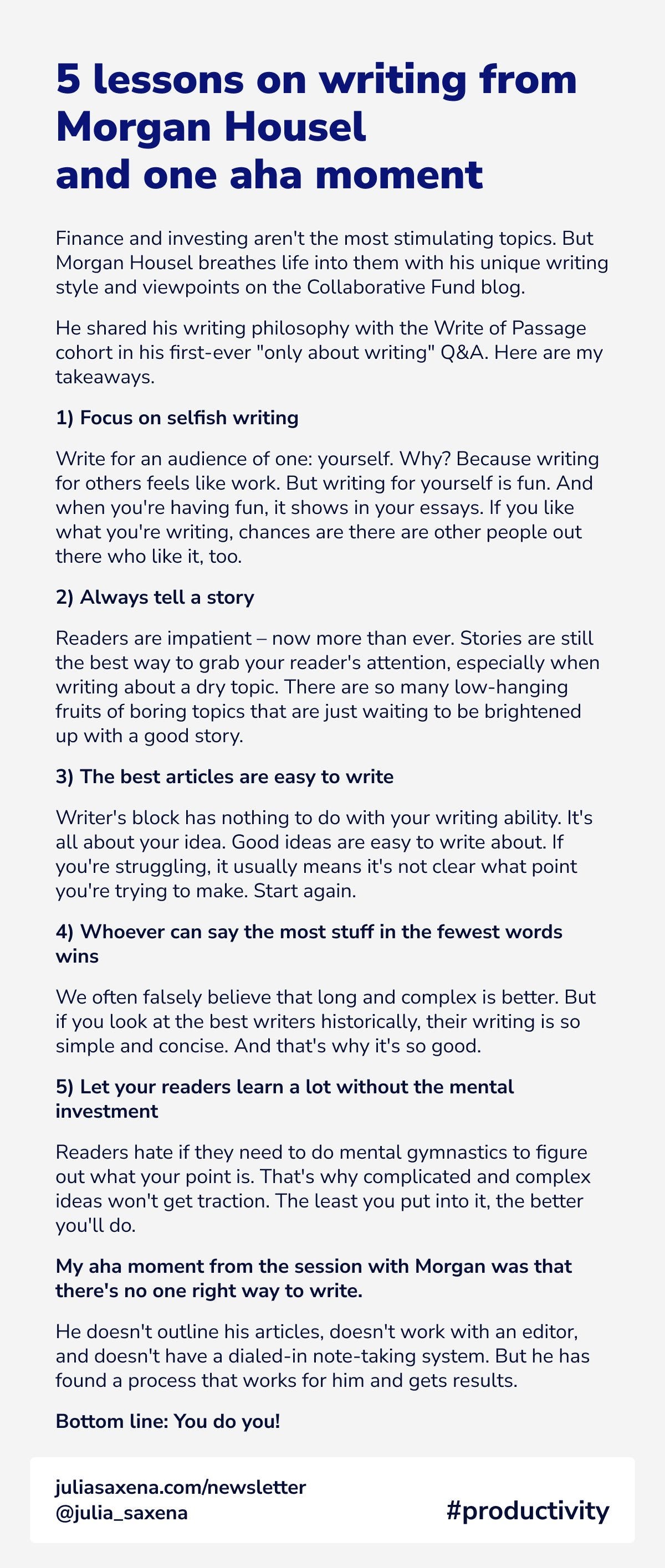

5 Lessons on Writing from Morgan Housel

Book of the week: The Last Lecture

A lot of professors (esp. when they retire, move on) give talks titled 'The Last Lecture'. They are asked to mull over what matters most to them.

Randy Pausch, a computer science professor at Carnegie Mellon, was asked to give such a lecture - only difference being, he was recently diagnosed with terminal cancer and given a few months of good health left in his tank. He didn't have to imagine it as his last, since he knew what his near future held for him.

Titled, 'Really Achieving Your Childhood Dreams', his lecture (and book) is what I think every educator (eg: professors, teachers, parents) and students likewise should read. It is a book which tells us about the importance of overcoming obstacles (brick walls), of enabling the dreams of others and all while maintaining a positive and upbeat attitude.

I sincerely hope everyone grabs this gem to read. It’s a short book, written in very simple language, filled with humorous anecdotes from Randy’s life.

Link to the lecture below:

Till next time.

Always remember: human innovation always trumps fear.