One Step Up #42

This week we look at the Tiger Phenomenon, Bezoz's final letter, How Jeff Yass made a fortune from lessons in Poker & Betting, A Drug’s Convoluted Journey from Factory to Patient + more

If you want to understand the state of the venture/growth market right now - and why almost every high profile deal has Tiger Global Management on it’s investor list - this is your article to read.

The Tiger Flywheel

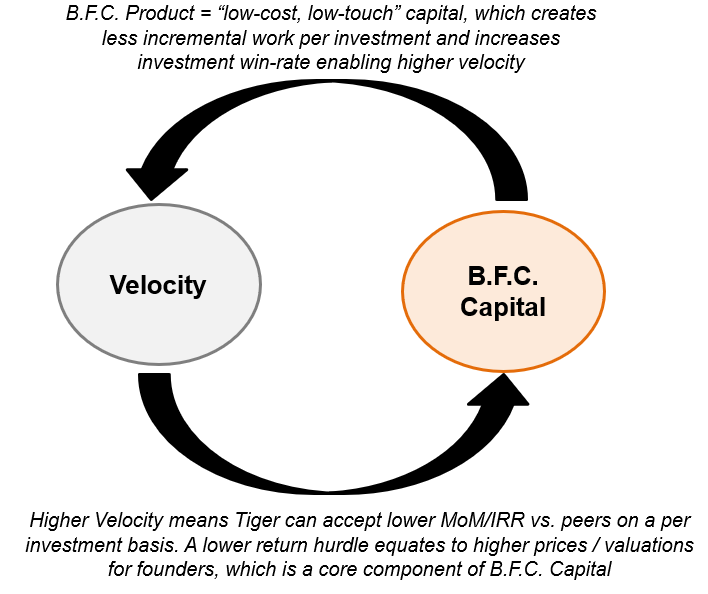

Maximum Deployment Velocity and B.F.C. Capital (better, faster, cheaper) are powerful because when used together they create a flywheel that enables a venture strategy that has never been used or seen at scale.

In addition to their direct flywheel, both Velocity & B.F.C. Capital have their own flywheels in relation to the returns that the strategy generates. Here’s my best attempt at drawing out the what that looks like:

It’s no Amazon flywheel, but the significance here is that venture/growth is generally devoid of flywheels / sustainable competitive advantages / moats, excluding those driven by brand (which are rare).

Tiger has developed the first structural, non-brand driven competitive advantage and flywheel at scale in venture. And they did it by throwing away a bunch of stale norms and made-up rules about how venture/growth should be practiced, and replacing them with a system that enables them to outcompete VCs on their own turf.That is why Tiger is going to eat VC.

Each and every sub-section now has a company which is focused on meeting that demand.

Jeff Bezoz’s Final Letter to Shareholders as CEO

Create More Than You Consume

If you want to be successful in business (in life, actually), you have to create more than you consume. Your goal should be to create value for everyone you interact with. Any business that doesn’t create value for those it touches, even if it appears successful on the surface, isn’t long for this world. It’s on the way out.

Differentiation is Survival and the Universe Wants You to be Typical

We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen.

You have to pay a price for your distinctiveness, and it’s worth it. The fairy tale version of “be yourself ” is that all the pain stops as soon as you allow your distinctiveness to shine. That version is misleading. Being yourself is worth it, but don’t expect it to be easy or free. You’ll have to put energy into it continuously.

The world will always try to make Amazon more typical – to bring us into equilibrium with our environment. It will take continuous effort, but we can and must be better than that.

How Trader Jeff Yass Parlayed Poker And Horse Race Handicapping Into A $12 Billion Fortune

Yass is the cofounder and head of a global trading powerhouse named Susquehanna International Group. His firm is the largest trader of listed stock options in America by some measures and like Citadel, Susquehanna’s skilled traders devour the order flow coming from free trading apps like Robinhood. In 2020, Susquehanna’s quants traded some 1.8 billion stock options contracts, 80% more than the prior year, and accounting for nearly a quarter of all options trades in the U.S., according to Alphacution Research.

Yass’s number one trading rule is also the mantra of every poker pro: there is no surer way to win, than to bet against someone who is dumber or less experienced than you, otherwise known as the “mark” at any poker table.

Phenomenal story of Jeff Yass, the scale at which his firm operates and his unique background in sports betting and gambling which he attributes to much of his success.

A Drug’s Convoluted Journey from Factory to Patient

A long read on the pharmaceutical supply chain and how the money flows between the different parties involved.

Top highlights:

Remain curious, never convinced

When the inputs change, so will the outputs

Math leaves no room for opinions (including our own). While the crowds predict and debate what should happen next, we humbly measure numbers for a better understanding of what is happening.

Three long reads I found particularly insightful:

Till next time.

Discipline equals freedom. That’s not a contradiction, it’s an equation.

-Jocko Willink