One Step Up Issue #25

This week we look at Intel & disruptive innovation, Andrè Kostolany, the story of how H-E-B planned for the pandemic, why your first customer is worth $10m & advice from Rich Handler (Jefferies Group)

Featured article:

Intel’s Disruption is Now Complete

Just like its partner in the PC era, Microsoft, Intel was so ensnared by its success in the PC paradigm that it couldn’t see out of it. With that — and the margins associated with its success — it saw no need to question its winning formula: that of integration of chip design and manufacturing. A promising customer (Apple, for its iPhone) comes knocking with something that doesn’t look to have the same margins as the existing business?

Not interested.

Yesterday, Apple announced the first Macs that will run on silicon that they themselves designed. No longer will Intel be inside. It’s the first change in the architecture of the CPU that the Mac runs on since… well, 2005, when they switched to Intel.

There’s a lot of great coverage of the new chips, but one piece of analysis in particular stood out to me — this chart over at Anandtech:

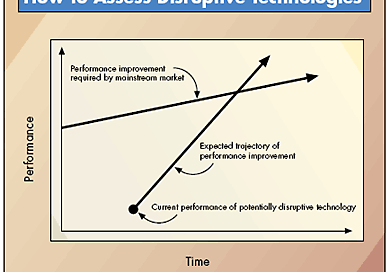

What about this chart is interesting? Well, it turns out, it bears a striking resemblance to one drawn before — actually, 25 years ago. Take a look at this chart drawn by Clayton Christensen, back in 1995 — in his very first article on disruptive innovation:

He might not have realized it at the time, but when Grove was reading Christensen’s work, he wasn’t just reading about how Intel would go on to conquer the personal computer market. He was also reading about what would eventually befall the company he co-founded, 25 years before it happened.

Great Stock Market Operators Never Heard Of: Andrè Kostolany

At the stock exchange, 2+2 are never 4 but 5 minus 1. Better to be prepared to stomach the -1.

One of Kostolany’s favourite anecdote is him on his first day on the trading floor of the Paris stock exchange. An older man was scrutinizing him and later asked for whom he was working. Kostolany answered: "Well for the Firm XY." "Aha", replied the old man, "Your boss is an old friend of mine. Thus, I better give you the most important piece of advice on how this business really works. Everything depends on if there are more idiots than stocks or more stocks than idiots".

Inside the Story of How H-E-B Planned for the Pandemic

H-E-B is a supermarket chain based in Houston, Texas. Their playbook for this pandemic?

Working on this since 2005 when there was the threat of H5N1 in China.

In 2009, they actually used that plan in response to H1N1, when the swine flu came to fruition in Cibolo, and refined it, made it more of an influenza plan.

Always stayed in close contact with several retailers and suppliers around the world - in China, starting with what happened in Wuhan in the early couple of months, and what kind of lessons they learned. Then over the last couple of months, with some of their Italian retailers and suppliers, understanding how things have evolved in Italy and now in Spain, talking to those countries that are ahead in the curve.

Plan, keep your ears open and ask questions, empathize and lift others up. Look at the below example:

We’re partnering with the beer distributors in Texas, for the first time ever, to deliver eggs to our stores. We’re seeing these types of businesses coming together in a powerful way to support each other, and it’s a wonderful thing.

Why your first customer is worth $10,000,000

…the first customer is the least profitable! They take the most effort, the most attention, the most support, and the most duct tape of any customer to come! Hundreds of hours of founder and early employee work go into building for, earning, and keeping those first customers. Those customers are wildly unprofitable on a unit economic (CAC / LTV) basis, and an accounting basis... and quite possibly even a morale basis.

The projected enterprise value change when a company goes from 0 customers to 1 customer is... approaching an infinite % increase, because at 0 customers a company is by default worth $0. When you don't have any customers, the thing that will add the most value to your business is adding your first customer.

When a young company adds one customer, they aren't just adding the LTV of that customer. They are also adding the likelihood of winning other customers with similar problems. They gain some incremental credibility, some incremental scale, and lessons to carry forward.

Think about early sales’ impact on projected enterprise value, and it is clear winning and keeping customer one is a company's most important job. Your first customer may be worth millions of dollars to your enterprise value. It may take you from uninvestable to investable.

20 Things I Wish Someone Told Me The Day I Started My Career As An Analyst On Wall Street

Rich Handler, Chairman & CEO of Jefferies Group, is a 30 year Wall Street veteran. Over this course, he’s mentored many an analyst. I particularly liked his candour on man topics - and my favourite piece from this was:

When you take the time to truly develop a relationship with someone who is also at the age of fighting to become relevant, that bond can become a foundation that can last a lifetime.

Now, for some daily dose of humor.

John Malone is by most people’s standards, one of the greatest capital allocators of his generation (well chronicled in the book “Outsiders” by William Thorndike). His response on Liberty National’s ownership in Live Nation (online ticket sales platform) had me laughing.

You’re talking about rock musicians; this is not my kind of thing. I don’t like a business where the assets go up and down on elevators. I like them to be fixed, hung on poles or up in space going around.

Till next time.

Always remember: your mindset is what defines you. That is your super power. What the mind can conceive, it can achieve.

Billy Beane (Moneyball) explains why he failed as a baseball player: