One Step Up Issue #4

This week, we look at how to think about valuation, the similarities between rappers and successful businesses, Growth without Goals, inside the mind of Jamie Dimon and Pepsi's deadly mistake

Hi everyone! Beginning this week, I’m going to start sending this newsletter out every weekend.

As your time horizon increases, your return becomes completely dependent on the company’s average return on equity capital. This thread breaks down/decomposes the components of your returns and highlights which factors are most important and how to think about them.

Rappers are walking Business Empires

“I'm not a businessman; I'm a business, man.”

Just as you can attribute particular business decisions to the success of Nike, Apple, or Netflix, you can break down the individual careers of Jay-Z, Kanye West, and Drake, respectively, in the same light.

Jay-Z and Nike: building an iconic brand

Kanye West and Apple: creative innovations that redefined their industries

Drake and Netflix: navigating industry paradigm shifts with a focus on viralityIncredible article highlighting how to think across fields and find patterns and parallels across music and business.

Long-term thinking is really just goalless thinking. Long term “success” probably just comes from an emphasis on process and mindset in the present. Long term thinking is also made possible by denying its opposite: short-term thinking. Responding to a question about the “failure” of the Amazon smartphone, Bezos said “if you think that’s a failure, we’re working on much bigger failures right now.” A myopic leader wouldn’t say that.

Success is about building a set of daily practices, it is about growth without goals. Continuous, habitual practice(s) trumps achievement-based success.

I think “accomplishments” are traps. Accomplishments, by their very definition, exist only in the past or future—which are not even real things. Pride is the worst of the seven sins and it is closely related to past and future accomplishments.

Inside the Mind of Jamie Dimon

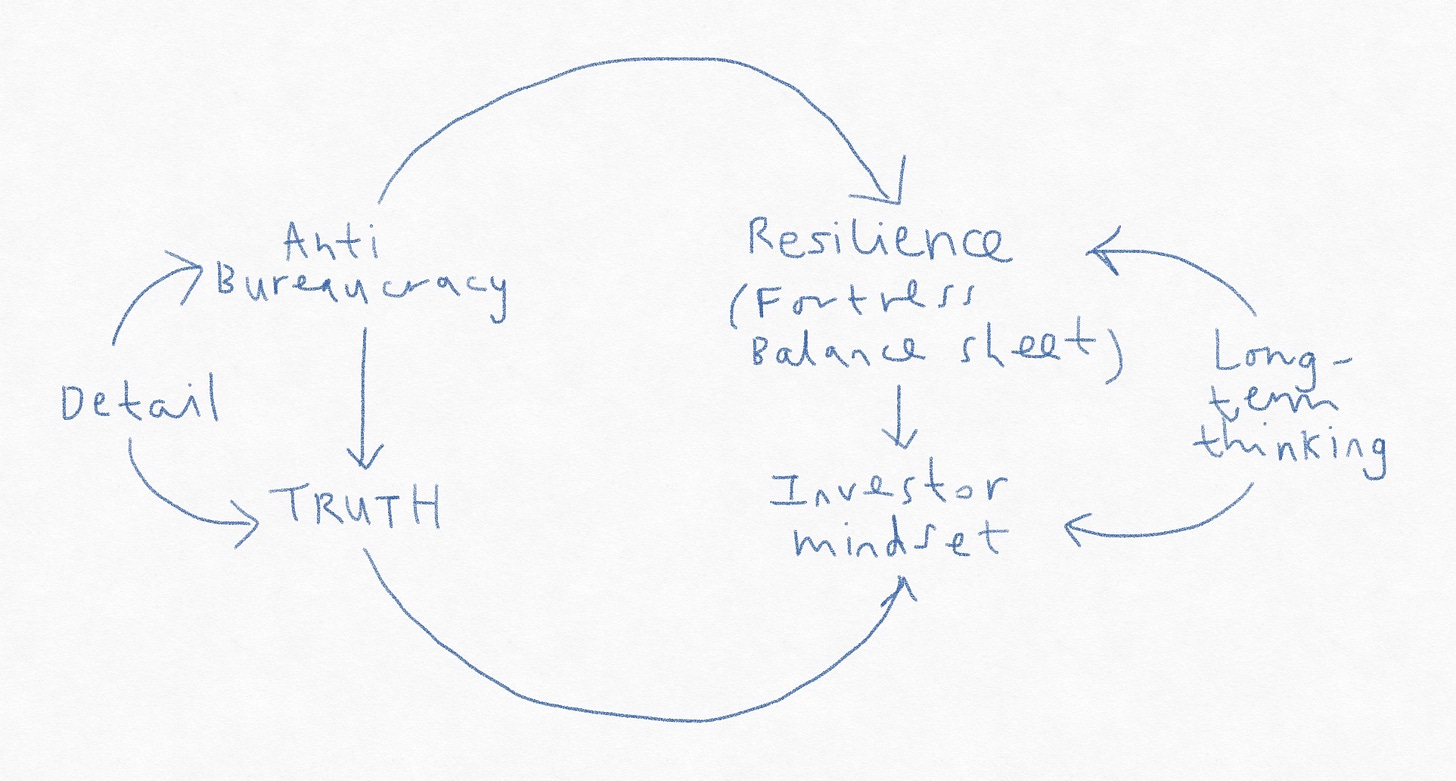

Jamie Dimon is Wall Street’s poster child. The third longest serving CEO of a major bank in the world and 20 years leading JP Morgan and its predecessor Bank One, he has managed his bank through two recessions and is in the midst of navigating a third.

Dimon’s understanding and awareness of risk has benefited JP Morgan over the years.

Risk is not symmetrical. You can make a lot of money in the good times, but if you aren’t careful, you’ll go bankrupt in the bad.

The article highlights key traits Dimon exhibits which has led to his success as a CEO.

How a computer error led to deadly riots and a war on Pepsi

Buying a specially marked Pepsi product allowed consumers to match the number underneath the bottle cap to the announcements. While most prizes were just 100 pesos (roughly $5 in today’s U.S. currency), there was an opportunity to win the grand prize of one million pesos, or the equivalent of $37,000 to $40,000.

The Philippines was a country struggling with a modest economy and widespread poverty, and that grand prize was perceived as a life-changing amount of money. So when 349, that night's winning number, flashed on screen that night, tens of thousands of Filipinos couldn’t believe their luck. The number was associated with the largest prize in the sweepstakes. The next morning, Pepsi plants in Manila were overrun by people toting their 349-emblazoned bottle caps and looking for the promised reward.

There wasn’t one.

Only two of the grand prizes were supposed to have been doled out. Instead, Pepsi had somehow manufactured 800,000 caps with the winning number. Consumers were told the company had made an error and were turned away in droves. Barbed wire was erected around the plants. Riots, boycotts, and picketing ensued. Homemade bombs were launched at bottling factories. In the words of one Pepsi executive, “we had death threats for breakfast.”

If you liked this newsletter, please feel free to subscribe and share it with your friends, family and colleagues! Thank you.

Till next time.

The sooner you start, the sooner you improve.

Jay, the content you curate is brilliant. Thanks