One Step Up Issue #7

This week, we look at higher education, Disney's education flywheel, spin-off investment ideas, Twitter, a new trend in the venture capital industry, Singapore's genius and Serum Institute's bold bet

This week’s post coming in a little early to help you spend time reading quality content over the weekend.

Don’t Go To College this Fall by David Perell

A lot’s been said and done the past two weeks in higher education.

Leading universities have maintained their ludicrous fees and the U.S. Immigration and Customs Enforcement (ICE) came out with a policy saying if your college is holding classes completely online this fall (which many universities have already announced), you have a short duration to leave the country and go back home.

Leaving aside the economic and emotional impact of this for students who dream of relocating to the US, known as the land of opportunities, the logistical and technological challenges such a move presents for many immigrant students who come from countries with relatively poor infrastructure (and don’t get me started on the time difference) is huge.

With that backdrop, David’s essay strikes the right tone - I wish I’d received this advise myself when I was 18. This tweet summarizes what the essay is about:

What constitutes a good business? (h/t @HurriCap)

Patrick tweeted this and no sooner we had some incredible answers from people all around the world: What is the most interesting business essay you’ve read in 2020?

Kalani was kind enough to summarize all of them and share it with everyone (link in red).

Twitter Signals Interest in Developing Subscription Service

The inability of Twitter to capture the (financial) pie of the advertising revenue puzzle has been frustrating for many. This has led to activist investors and individual investors alike to recommend different routes to create value.

Suggestions for $TWTR cc: @jack @kayvz @boo @paraga @michaelmontano - re-launch Vine - launch a citation feature to show info backing tweets - launch premium feeds w/ unique content or longer form e.g. substack - examine patreon biz model as well as Twitch (sub benefits)

Suggestions for $TWTR cc: @jack @kayvz @boo @paraga @michaelmontano - re-launch Vine - launch a citation feature to show info backing tweets - launch premium feeds w/ unique content or longer form e.g. substack - examine patreon biz model as well as Twitch (sub benefits)While little is known about the subscription service, here’s to hoping it can create value for shareholders (for context: it’s share price is below the price at which it IPO-ed in 2013).

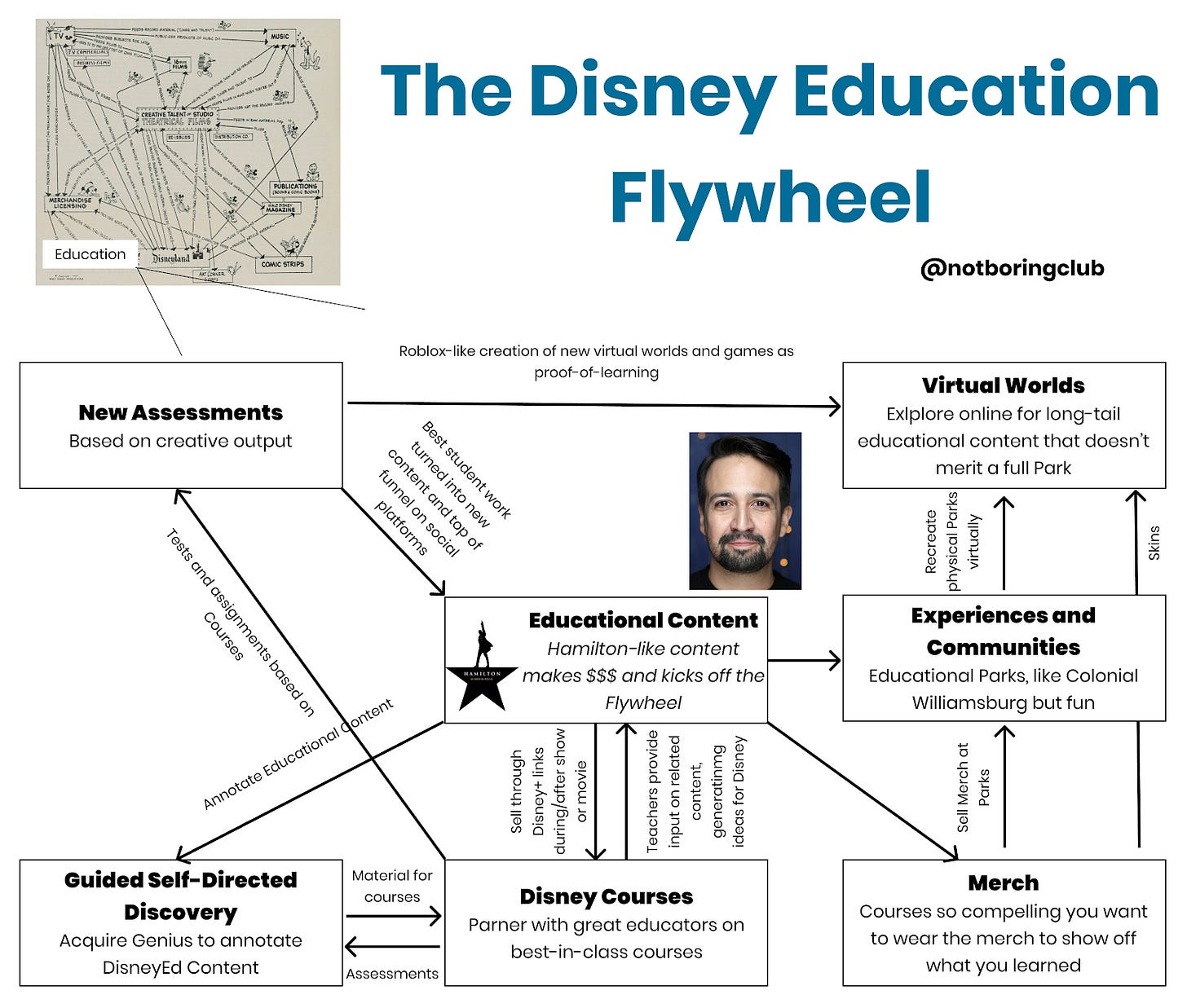

Hamilton & Disney's Education Flywheel

To this day, Disney operates based on a Flywheel that Walt Disney drew in 1957.

What is the Disney Flywheel? Everything that Disney owns works together and feeds into each other. Disney creates and acquires worlds and characters (its intellectual property, or “IP”) for movies and shows. It builds theme parks based off of the same IP, entices people to visit those theme parks through its movies and shows, and sells them merchandise based off of that IP when they’re in the parks. Owning Disney merchandise builds a deeper affinity with the brand, which makes consumers want to go see the next movie, which reignites the flywheel.

Earlier this week, Disney premiered Hamilton, the musical on one of America’s founding fathers on Disney+. And that got a few geniuses thinking -

What will Disney’s flywheel look like if and when they enter the Education sector?

Packy’s analysis is one of the best articles I’ve read this past week!

The Rise of the Solo Capitalists

Angel investors have been very important members of the fundraising ecosystem for a long time.

But over the last couple of years, there's been an increase in individuals investing not just at the earliest stages of companies, but at the Series A and beyond.

And they aren't just participating in financings alongside venture firms. These individuals are often competing against venture firms for the right to lead rounds, and signing term sheets before the companies get to pitch the traditional venture partnerships. Most importantly, founders are choosing to work with them, in some cases in lieu of partnering with firms.

This is something I was told in my first week on the job as a consultant - you have to carve out your individual brand. That brand will stay with you wherever you are - be it at your current firm or your next.

The importance of an individual's brand has been steadily increasing in venture capital for quite some time. Founders are more often than not picking an individual partner who they want to work in a financing round, based on the relationship built with them, and based on their brand and expertise, instead of the firm's.

The Genius of Singapore from a cultural perspective:

Singapore remains one of my favorite cities in the world. Close to home, diverse, fabulous food, beaches, clean air, a vigilant government and a rich history.

In a policy that began in 1989, HDB blocks require minimum levels of occupancy of each of the main ethnic groups in the city — Chinese, Malay and Indian — to prevent the formation of “racial enclaves.” The government continues to implement what one senior minister once called the “most intrusive social policy in Singapore” to encourage social harmony.

Source: Why Singapore Has One of the Highest Home Ownership Rates

Investment ideas:

Spin-offs have historically been attractive hunting grounds for value investors. Two that have come up more recently:

IAC/Match Group:

Decoding APIs for Product Managers

As someone who doesn’t understand the technicalities behind coding, this article did a lot in terms of helping me understand a term that is so loosely throw around today (especially by FinTechs): APIs.

Indian Company Starts Mass-Producing Coronavirus Vaccines Before Trials

Earlier this week, I read that India’s Serum Institute, led by Adar Poonawala has started mass producing Covid-19 vaccines before trials.

The company is the world's largest vaccine producer by volume. Its polio, tetanus and measles vaccines normally take years to bring to market through clinical trials, regulatory approval and then manufacturing. But these are not normal times. And so when it comes to the coronavirus, Poonawalla is skipping some of those steps.

Rather than waiting to see which ones are effective, he went ahead and started mass production. The rationale? He will already have hundreds of millions of doses to hand out right away.

But what really blew me away was this:

Because we're privately listed and not accountable to investors and bankers and shareholders. It was just a quick five-minute chat between myself and my father.

I’ve often wondered, if you’re a capable manager with sufficient capital at your behest, is there any benefit in going public?

Till next time.

If you liked this newsletter, please feel free to subscribe and share it with your friends, family and colleagues! Also leave a comment below if you want to give any feedback and/or want to engage in a conversation.

Thank you.

Great work Jay. I eagerly look forward to reading content that you curate weekly. Keep up the awesome work. Kudos!!